Construction Mortgages & Draws

Most construction projects are financed in whole or in part by a third-party lender, which means that understanding the draw process is crucial for the successful completion of a construction project.

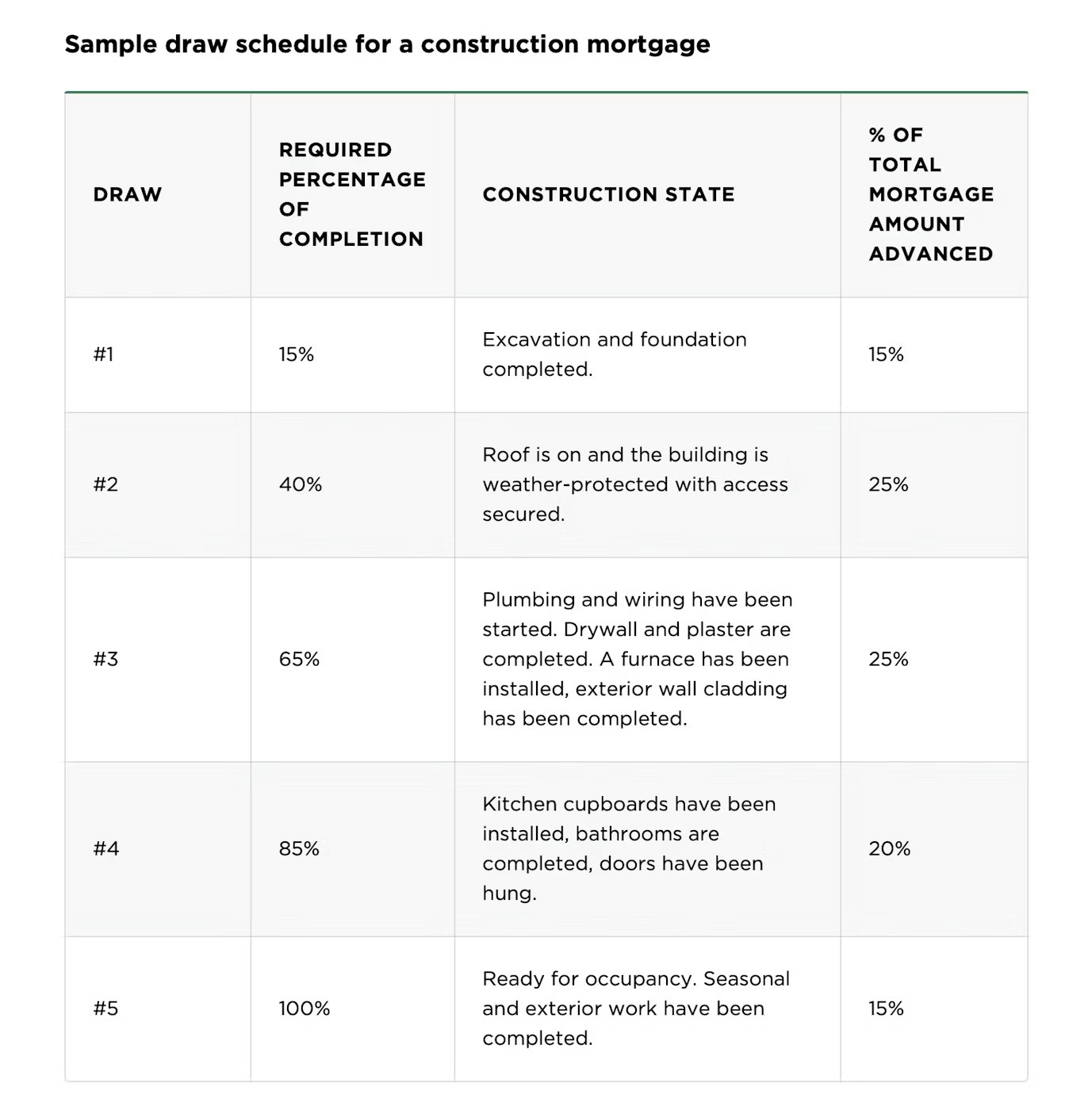

Construction mortgages are very different from just your standard mortgage. The full amount is not given all at once, but a certain percentage of the funds, called Draws, are released at predetermined milestones, such as completion of foundation, framing, or major installations. This is called a Draw Schedule. This ensures that homeowners have access to the necessary capital precisely when it's needed, aligning with the progress of their project.

With a draw schedule in place, an owner or project manager will submit a detailed report of the work completed at certain points in the project. This report should be substantiated by a bundle of various documents offered as proof of the work performed. If everything checks out, payment will be released. This bundle is commonly referred to as a draw request.

Here is an example of a Draw Schedule based on the state of construction👇🏼

No lender will disburse funds from a construction draw request without a construction draw inspection. The lender is not an expert in construction, so they will usually employ a third-party to conduct the inspection. The inspector will not evaluate the quality of the work nor ensure that the work meets any required permits or codes. However, the inspector verifies that builder has completed the work indicated on the construction draw request. Additionally, the inspector evaluates the progress of the construction project against the draw request.

Understanding the intricacies of your bank's construction mortgages and draw schedules is crucial. So what happens if you don’t have enough money to get you to the next draw?

With or without the help of your General Contractor, it is up to you to manage your money. This is, however, why most invoices you will receive will give you 30 days to pay. Use it wisely and understand that they have bills to pay as well (like your supplies on their visa). You don’t pay your bill on time, you run the risk of them not coming back to finish the work until you pay, putting a lien on the house, and / or going to Small Claims Court or a Civil Resolution. Word can also get around to the rest of the trades on the project, and even around town.

Pay your bills, even if it out of your personal pocket for the time being, and speak with a Mortgage Broker / your bank about a Construction Mortgage for your new home or renovation.

Download our Draw Schedule and plug in your numbers.

Let's move on to the next lesson